While doing my morning reading, I came across Jeanne Roué-Taylor’s article, What good is marketing insight without action? In the article, Jeanne notes that, “A great model brings together data from several sources, feeds analytics, makes predictions, enables test-and-learn scenarios, and allows the organization to adapt as data, channels, and other factors change over time. In a nutshell, models support an organization’s ability to be dynamic and responsive.”

While doing my morning reading, I came across Jeanne Roué-Taylor’s article, What good is marketing insight without action? In the article, Jeanne notes that, “A great model brings together data from several sources, feeds analytics, makes predictions, enables test-and-learn scenarios, and allows the organization to adapt as data, channels, and other factors change over time. In a nutshell, models support an organization’s ability to be dynamic and responsive.”

It got me thinking about how predictive analytics and big data can improve our current sales and marketing outreach, and make organizations more “dynamic and responsive.” While there are a host of different ways that these technologies can improve sales and marketing, I’ve been thinking about two in particular:

-

Predictive analytics can surface the right time for salespeople to reach out.

-

Big data can make it easier for them to cross-sell and upsell.

In this post, I want to talk about how the convergence sales and marketing software, predictive analytics and big data will shape buyer interactions in the future.

Using Predictive Analytics to Find the Right Time to Connect

Most automated outreach these days is built around some kind of email marketing our marketing automation platform that works off an event trigger, like visiting a landing page or downloading a white paper. The software uses if-then logic to follow up with the potential prospect and get them into the sales pipeline. A common workflow might look like the image below.

Source: Marketing Profs

This type of programmatic logic is really useful and it’s the foundation a lot of marketing and sales technology. But predictive analytics can take it one step further to refine the outreach process.

Let’s say that someone visited a product landing page, went off to another site on the Web and then came a few days later. A lot of automated marketing systems might suggest that you email that person to see if they’d like to know more about the product page they just visited. But people visit a lot of product pages on the Web all the time, and that doesn’t always mean that they’re ready to buy.

Predictive analytics could go out and crunch all the disparate sources of data and give more meaning to those landing page visits. For instance, if there was news how visitor’s company recently took a round of venture capital funding or bought a new office, the software might see this and then understand that the company is in a period of growth-and only after seeing that the person visited your product landing page and they’re in a period of company decide to reach out. The email could be an invitation to discuss the how the product can help me in this time of company growth, rather than a simple follow up after visiting a landing page.

Knowing What to Offer, and When to Offer It

In my view, there’s also an opportunity for big data to better inform how salespeople interact with and what they offer existing customers. There’s a lot of potential for data crunching to inform cross-sell and upsell opportunities.

Cross-selling and upselling can be a great way to generate topline growth. However, it’s often very difficult to know what to sell or who to sell it to. As AJ Gahndi, vice president of customer solutions at Lattice Engines, put it in a recent conversation, “Many companies have 30 to 50 products that they can sell any customer on. If you consider that the average salesperson carries 20 to 100 accounts, you suddenly have 600 to 1,000 different choices a salesperson can make on who to call and what to sell them on.”

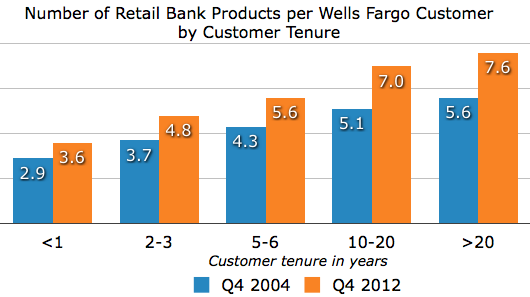

That’s a lot of choices to make-and a lot of room for human error. That’s where I think big data can help out. A lot of companies are already crunching internal data such as a customer’s account balance, their transaction history and certain life events to try to predict what product any particular customer might need next. Take, for instance, Wells Fargo. They’re the poster child of the cross-sell because they’ve become incredibly successful at using account information to predict what product of theirs a customer might need next. As a result, Wells Fargo also now sells more financial products to each of its retail customers–an average of 6.1 products in 2013, up from 5.9 in 2012–than any other financial institution.

Source: Wells Fargo graphic created by Software Advice

But it can go one step further to crunch more sources of customer data.

For instance, big data technologies might start to monitor a customer’s questions on Quora or Twitter and then feed that data to sales reps where they could use that information in a sales call. While most sales calls are still based off a script, big data technology dynamically adjust that script to tell salespeople they should talk about how their product or service can answer questions that I’d just been asking elsewhere on the Internet. Having that kind of a personalized tailored pitch would be a powerful weapon in a salesperson’s arsenal.

As these technologies become more efficient and effective, marketers are salespeople will be able to make more meaningful connections than before. While I still think that Marketo had a great and timely email to me, it can get better. And we’re living in an exciting time where we can watch all of it unfold.

All Things D

All Things D ARS Technica

ARS Technica Engadget

Engadget GigaOM

GigaOM Mashable

Mashable TechCrunch

TechCrunch The Verge

The Verge Venture Beat

Venture Beat Wired

Wired Chris Brogan

Chris Brogan Brian Solis

Brian Solis Chris Dixon

Chris Dixon Clay Shirky Blog

Clay Shirky Blog HBR Blog

HBR Blog IT Redux

IT Redux Jeremiah Owyang

Jeremiah Owyang Radar O'Reilly

Radar O'Reilly Seth Godin Blog

Seth Godin Blog SocialMedia Today

SocialMedia Today Solve for Interesting

Solve for Interesting The TIBCO Blog

The TIBCO Blog Lifehacker

Lifehacker

I like your email example, but users are demanding a personalized experience now in real-time on vendor’s websites. An anonymous prospect’s digital behavior, location, company and organization can all be available to increase top-funnel interaction and conversions. We’ve seen it, and it does provide helpful information to our sales team as well. Tamar, Insightera